From Constant Calls & Stacking Bills → Calm, Clear Finances in 14 Days

We Break Down All Your Loans & Build a Realistic Repayment Plan — So You Know Exactly What to Pay by Day 14

We’ll map out your entire debt situation and show you the exact next steps to take back control, fast.

learn how wE DO IT IN 14 DAYS

Private

No-pressure

No false promises

You’re not alone, and you’re not out of options.

We help everyday Singaporeans take back control of their finances, without more loans, shortcuts, or shame.

You’ve Tried Everything…

But the Stress Keeps Coming Back

Maybe you’ve…

Lost sleep wondering how long you can hold on

Been chased by banks, collection letters, or worse

Been making minimum payments, but your total debt won’t budge

Embarrassed to ask for help, even though you’re trying your best

You’re doing all you can. And that’s exactly why we’re here.

EDUdebt has already helped 15,000+ Singaporeans since 2016, saving over $80 million in interest and growing debt.

You’re not alone anymore!

It’s Not Just the Debt.

It’s the Burden You Carry in Silence

Banks won’t slow down. The calls won’t stop. You’ve kept it to yourself because the last thing you want is to be judged.

You don’t want to tell your family. You don’t want your friends to know.

The guilt. The shame. The fear of being judged. So you carry it alone—and it’s exhausting.

Most people don’t realise that once debt hits a tipping point, every day of delay shrinks your real options.

We help you figure out those options—calmly, privately, and without pressure—before it’s too late.

WHAT MAKES US DIFFERENT?

Not Another Sales Pitch. Not Another Gimmick.

Just Real Talk.

Private & Judgement-Free

We understand the shame, stress, and fear. You won’t get any of that from us.

Transparent from Day One

No hidden fees. No fine print. No bait-and-switch.

Ethical by Default

We comply fully with Singapore’s financial regulations. No upsells. No quick-fix lies.

People-First Approach

This is about long-term financial peace, not short-term Band-Aids.

"manageable repayment.."

"Consolidate all your debts into a single, manageable repayment." - Zaidi Isnin

"saving you thousands"

"Freeze all accruing interests, saving you thousands in the long run." - Tarmizi Osman

"Tailored repayment plans"

"Tailored repayment plans based on your financial situation." - Marilyn Rui

"a debt-free life within 5 years"

"Achieve a debt-free life within 5 years – guaranteed." - Lionel Sze

Financial freedom starts with clarity and confidence. EDUdebt’s team of professionals specializes in simplifying complex debt issues, offering tailored solutions that deliver measurable results. With us, you’re not just a client—you’re on a proven path to success.

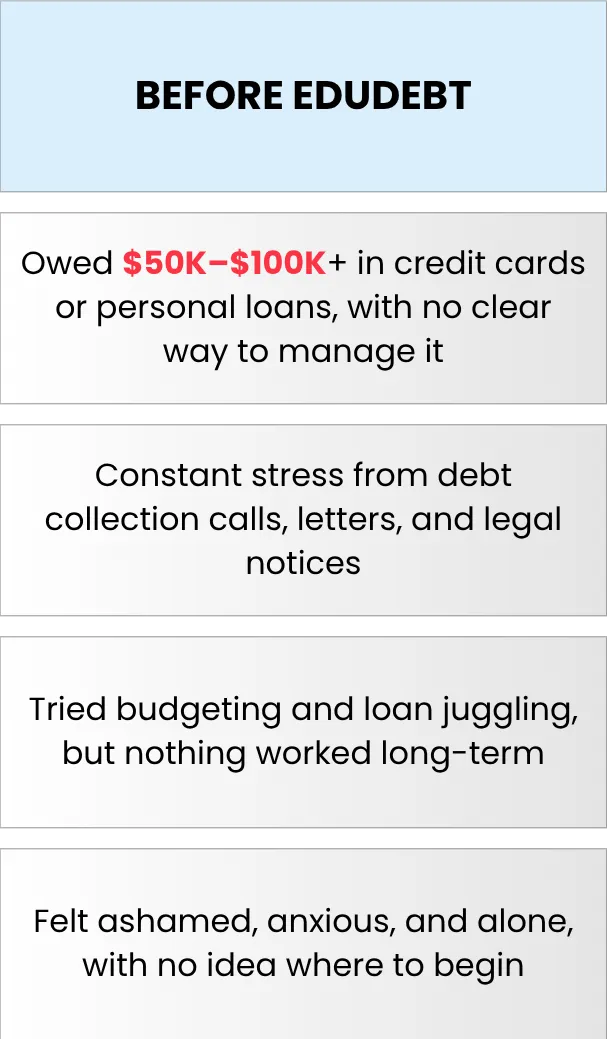

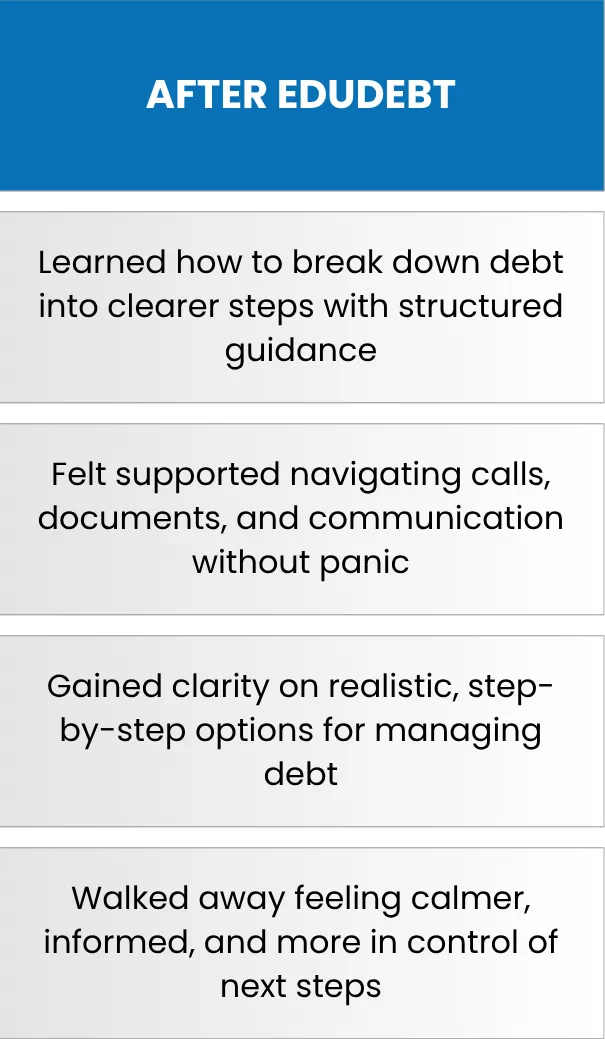

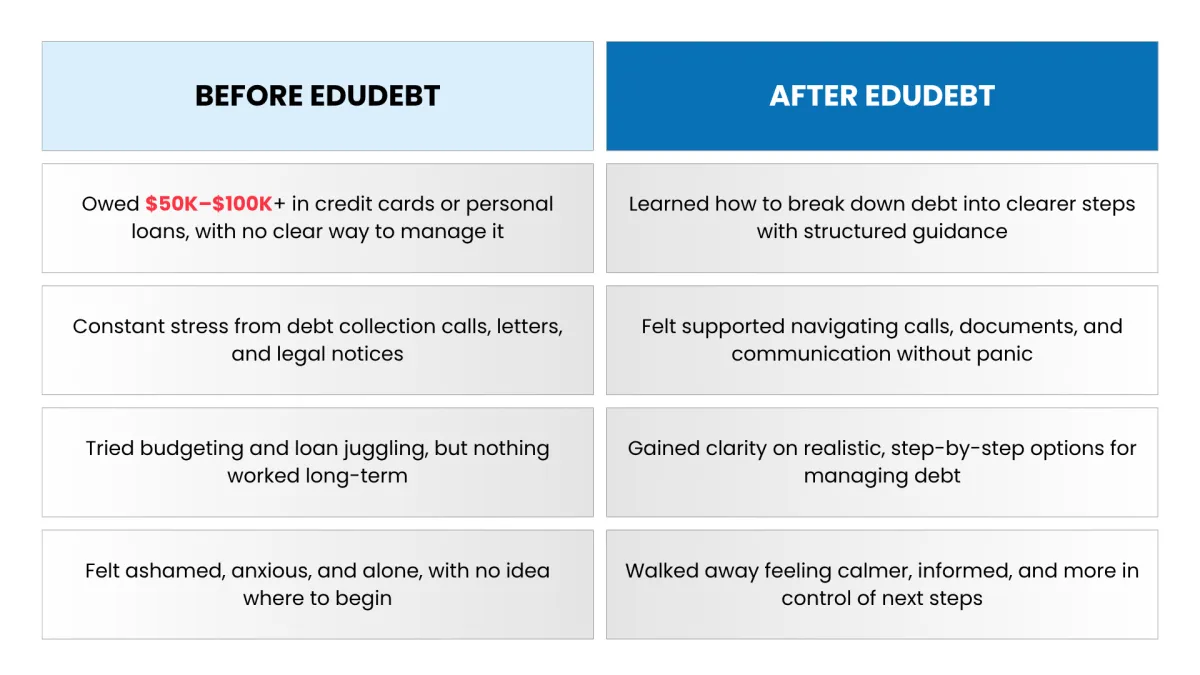

When It Feels Like You’re Drowning… Then You Finally Feel in Control Again

You don’t need to live like this.

We’re not here to judge. We’re here to listen and guide.

We Don’t Sell Dreams. We Help You Navigate Real Paths

Without More Borrowing

Our team supports individuals dealing with:

Personal loans

Credit card debt

Multiple overdue bills

Legal letters or collection notices

Overwhelm, fear, and financial anxiety

We don’t offer loans.

We don’t encourage bankruptcy.

And we NEVER suggest you take on more debt just to fix your debt.

Instead, we help you identify what legal and ethical support structures may be available for your situation, and guide you through what to expect if you pursue them.

Think It’ll Be Awkward or Pushy? Here’s What Really Happens on the Call

Many people ask: “What exactly happens when I reach out?”

Here’s what to expect:

Speak

with a trained consultant, not a pushy salesperson

Share

what’s going on, and we’ll actually listen

Get clarity

on what support options may exist

Leave the call

with a clearer head—even if you don’t work with us

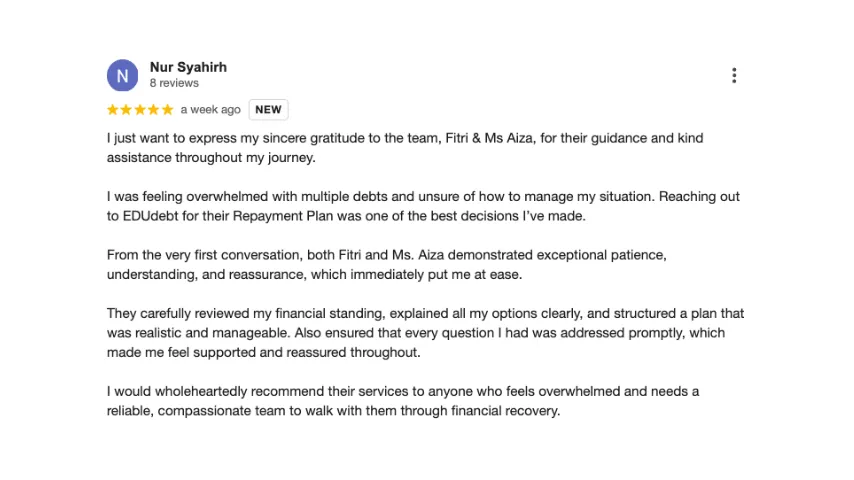

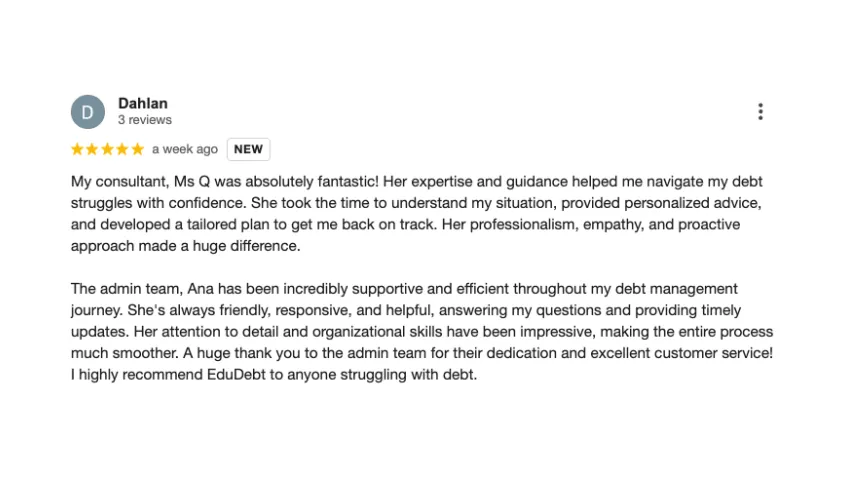

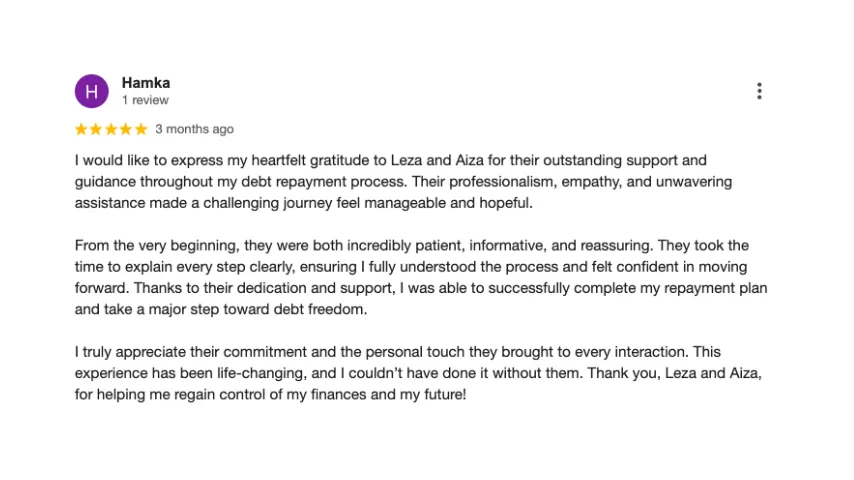

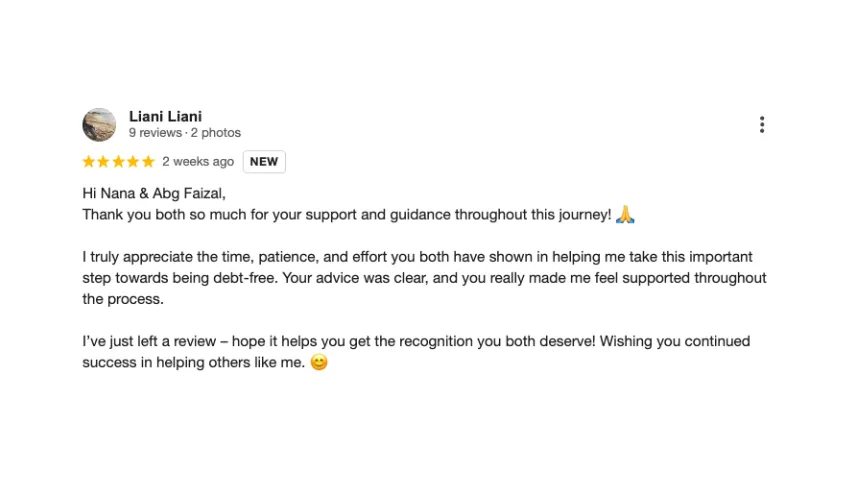

Don’t Just Take Our Word for It — See What Our Clients Say After Reaching Out

This Isn’t for Everyone. Is It for You?

This Isn’t for Everyone.

Is It for You?

We work best with individuals who are serious about change—no gimmicks, no empty promises.

If this sounds like you, there’s a good chance we can help:

✅ You’re facing credit card or personal loan stress

✅ You’re not bankrupt and want to avoid it

✅ You’ve been avoiding the calls, but you’re ready to take the first step

✅ You’re serious about change, but need someone to guide you

🚫 This is NOT for you if:

✘ You're looking for another loan

✘ You're not ready to take any action

✘ You’ve already declared bankruptcy

✘ You expect guaranteed outcomes without effort

If you’re still reading, you probably qualify.

No pressure. No judgment. Just clarity.

And if you’re employed, doing your best, and just overwhelmed, we’re here for you.

Still Got Questions?

These Might Be

Your Questions Too

These Might Be Your Questions Too

Do I need to pay anything upfront?

Your first consultation is 100% free.

Do you give legal or financial advice?

No. We provide educational guidance only. We're not a law firm or a financial advisory.

Will this affect my credit score?

We'll explain how actions may impact your credit before you make a decision.

Is this confidential?

Absolutely. Everything is private and discreet.

What if I’m not ready to commit to anything yet?

That’s completely fine. The consultation is just a conversation to explore your options—no commitment required.

Do I need to prepare anything before the session?

Not much. Just bring any letters or bills you’ve received (if any), and be ready to share what you’re facing.

Is there any obligation to continue after the first consultation?

No obligation at all. Whether you move forward or not, you'll leave the call with more clarity.

Debt Doesn’t Disappear on Its Own. But You Can Stop It from Getting Worse.

We’re not here to judge. We’re here to listen. And guide. If you’re ready to explore your next move—without pressure, lectures, or sales tactics—let’s talk.

Free Private Consultation

Takes Less Than 30 Seconds to Book

100% Confidential. No Commitments.

🔒 Disclaimer: EDUdebt does not offer legal or financial advice. We are not affiliated with MinLaw or any government body. All guidance is based on your unique financial profile and eligibility. Results vary.

This site is not affiliated with, endorsed by, or sponsored by Facebook, Inc. or any of its affiliates. We are an independent entity, and the opinions expressed here are our own. Facebook is a registered trademark of Facebook, Inc. Any references to Facebook or its platforms are for informational purposes only.

By interacting with this page or submitting your information, you acknowledge that we may use your data in accordance with our Privacy Policy. For more information about how Facebook handles user data, please review Facebook's Data Policy.